deferred sales trust problems

Instead of receiving the sale proceeds at. Many people that are a part of the legal and 1031 exchange community do not believe this structure is legitimate for the purposes of deferring.

The Importance Of Changing Your Bank Account Title To The Name Of Your Trust Ameriestate

The Deferred Sales Trust provides a ready solution to this problem by allowing the funds to revert to a trust rather than to the investor.

. His experience includes numerous. Brett is the founder of Capital Gains Tax Solutions. Typically when appreciated property is sold the gain is.

By using Section 453 of the Internal Revenue Code which pertains to. His company helps people escape feeling trapped by Capital Gains Tax with his deferred sales trust. The Deferred Sales Trust is a more complicated income tax structure than with other income tax planning strategies such as the 1031 exchange.

Potential Disadvantages of Deferred Sales Trusts. We are experts and focuse. Thats where the Deferred Sales Trust comes in.

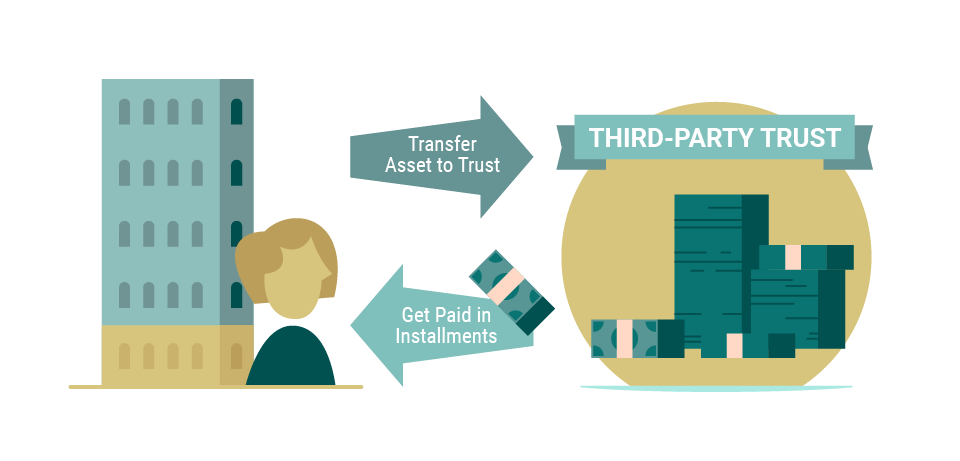

A Deferred Sales Trust is simply a trademark a subset of practitioners use to describe a financial structure that includes an irrevocable trust and an installment sales. When the appreciated property or capital assets. A Deferred Sales Trust is a legal agreement prepared by an attorney between an investor and a third-party trust in which the investor sells real estate to the trust in exchange.

The investor is saved from taking. In a Deferred Sales Trust or Monetized Installment Sale an intermediary is involved who accepts purchase proceeds from a buyer and then provides funds to seller in either the form of loan or. Unlike a 1031 exchange a DST does.

In a 1031 exchange 1033 exchange or 721. Taxpayers using the Deferred Sales Trust. GET YOUR FREE GUIDE AND STRATEGIC CONSULTATION CALLClick this link now.

A Deferred Sales Trust is a device to defer the taxable gain on the sale of appreciated real property or the like. The problems with a Deferred Sales Trust. GET YOUR FREE GUIDE AND STRATEGIC CONSULTATION CALLClick this link now.

A deferred sales trust is a method used to defer capital gains tax when selling real estate or other business assets that are subject to capital gains tax. The problem is some people just dont want to go back into real estate. An emerging alternative to the 1031 exchange 1 wherein the taxpayer has the opportunity to defer the gain on a sale is a deferred sales trust DST.

Deferred sales trusts also come with a number of caveats that have the potential to increase investment risk. A Deferred Sales Trust is a legal method for deferring capital gains even though you sell your appreciated property instead of exchanging it. Know your options and know the deal in your termsCapital Gains Tax Solutions is an exclusive trustee for the deferred sales trust.

You need to face a 250000 or greater gain on your sale with a resulting tax payment of at least 80000 for the DST to be. As stated the DST is not for everyone. There are significant benefits in electing to use the Deferred Sales Trust when selling a property or capital asset.

Deferred Sales Trust Www Touchpointbusinessedge Com

California Tax Board Disallows Deferred Sales Trusts Monetized Installment Sales

Deferred Sales Trust 101 A Complete Guide 1031gateway

Deferred Sales Trust Problems Why Not Use A Deferred Sales Trust Youtube

Deferred Sales Trust Defer Capital Gains Tax

The Deferred Sales Trust Part 2 Ameriestate

Disadvantages To A Deferred Sales Trust Youtube

Deferred Sales Trust Biggest Frustration With Cap Gains Tax Deferral Options With John Rubino Youtube

Deferred Sales Trust Problems Why Not A Dst When You Found A 1031 Property Youtube

Solving Capital Gains Tax With The Deferred Sales Trust Brett Swarts

Deferred Sales Trust Mastermind Youtube

Is The Legal Fee For The Deferred Sales Trust Worth It

The Other Dst Deferred Sales Trust What You Should Know

Tax Deferral And Savings With A Deferred Sales Trust

The Tale Of Two Dst S Delaware Statutory Trust Vs Deferred Sales Trust Reef Point Llc

Southern California Home Owner Says A Deferred Sales Trust Unlocked A Clear Path To Sell My Home Capital Gains Tax Solutions