does new hampshire have sales tax on cars

Whats the cheapest state to buy a car. Is New Hampshire A Tax-Friendly State For Retirees.

Is Buying A Car Tax Deductible Lendingtree

States like Montana New Hampshire Oregon and Delaware do not have any car sales tax.

. So when it comes to registering your vehicle in NH you will not pay any sales tax. If you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car. Car Sales Tax for Trade-Ins in New Hampshire Trade-ins can help lower the cost of purchasing a new vehicle.

New Hampshire is one of the few states with no statewide sales tax. Exact tax amount may vary for different items. However vendors in New Hampshire must register for other states sales taxes and collect taxes on retail sales when required by the other states.

However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to. If you buy from a dealer they will often collect this for you and remit to your home state. Prepared meals hotel rooms cigarettes motor fuels medical services thats all thats coming to mind off-hand.

New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states. Likewise if you try to register your new car in a different state with a sales tax you are typically required to pay a use taxtypically in the amount of the sales tax that would have been due if you boug Continue Reading Robert Watson. New Hampshire does not have a sales tax on sales of goods in the state.

As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. The New Hampshire Sales Tax Handbook provides everything you need to understand the New Hampshire Sales Tax as a consumer or business owner including sales tax rates sales tax exemptions and more. But if you come from a neighboring state such as Maine or Vermont you just cant go to New Hampshire and just.

No you will only pay taxes once to the state where you register the car. Does New Hampshire have sales tax on cars. New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055. New Hampshire does not have sales tax on vehicle purchases. The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states.

This means that no city has higher or lower car tax rates. However New Hampshire is one of five states that doesnt have any sales tax whatsoever. States like Montana New Hampshire Oregon and Delaware do not have any car sales tax.

This is imposed at the time the tree is cut at 10 the value of the wood. The tax is 76 percent for periods ending on or after December 31 2022. No there is no sales tax.

What states have the highest sales tax on new cars. Overall New Hampshire is the cheapest state to buy a car since registration fees are low and sales tax non-existent. That means you only pay the sticker price on a car without any additional taxes.

Property taxes that vary by town Auto registration fees A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption. New Hampshire may not have a car sales tax rate but there are still additional fees to be aware of. No there is no sales tax.

New Hampshire does not have sales tax on vehicle purchases. Nearly every state in the US implements a sales tax on goods including cars. Only a few narrow classes of goods and services are taxed eg.

You will also need to provide proof that the vehicle was acquired via. While states like North Carolina and Hawaii have lower sales tax rates below 5. NH is also one of the few states that doesnt charge a sales tax on vehicle purchases.

Does New Hampshire have sales tax on cars. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. For more information on motor vehicle fees please contact the NH Department of Safety. New Hampshire also has a timber tax.

States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. A 9 tax is also assessed on motor vehicle rentals. Therefore all residents of New Hampshire will not have to pay vehicle taxes.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. The New Hampshire cigarette tax of 178 is applied to every 20 cigarettes sold the size of an average pack of cigarettes. All of New Hampshire is tax-free for vehicle sales.

In fact the state is one of five states that do not have a sales tax. New Hampshire does not have sales tax on vehicle purchases. These five states do not charge sales tax on cars that are registered there.

Are there states with little to no sales tax on new cars. No sales tax No capital gains tax No inheritance or estate taxes New Hampshire does collect. 2022 New Hampshire state sales tax.

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

How Do State And Local Sales Taxes Work Tax Policy Center

New Hampshire Sales Tax Handbook 2022

If I Buy A Car In Another State Where Do I Pay Sales Tax

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

When You Buy A Car From New Hampshire Is There Sales Tax Sapling

Nj Car Sales Tax Everything You Need To Know

Understanding New Hampshire Taxes Free State Project

Cheapest Car Insurance In New Hampshire 2022 Wallethub Cheap Car Insurance In Nh Cheap Auto Insurance New Hampshire Cheap Insurance New Hampshire

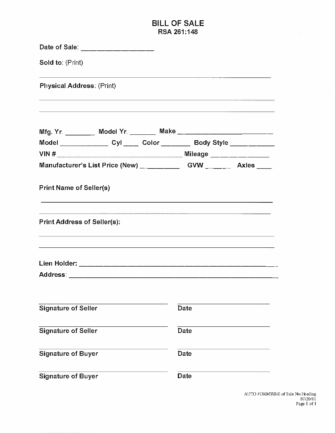

Free New Hampshire Motor Vehicle Bill Of Sale Form Pdf Word

If I Buy A Car In Another State Where Do I Pay Sales Tax

New Hampshire Excise Taxes Gasoline Cigarette And Alcohol Taxes For 2022

How To Buy A Car In Another State Tulley Mazda In Tulley Nh

A Complete Guide On Car Sales Tax By State Shift

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price